The Value of a Good CIBIL Score

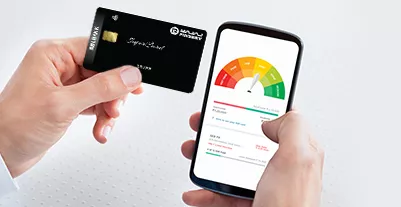

Your CIBIL score is what determines how creditworthy you are. The Reserve Bank of India (RBI) has authorised the Credit Information Bureau (India) Ltd.It is popularly referred to as CIBIL, to generate this score for an individual. The range of a real CIBIL score is 300 to 900, with 900 denoting the maximum degree of creditworthiness. Your chances of getting approved for a personal loan increase with your credit score.

How well you handle past debt repayment affects your CIBIL score. By paying all your debts—including credit card bills, loan EMIs, and other outstanding obligations—on time, you can keep your credit score high. On the other hand, missing a payment on a loan reduces your credit score.

A personal loan can be helpful when you’re short on money. However, you must pass the lender’s stringent requirements before the loan may be accepted. To get a general sense of how much money you can borrow, utilise the personal loan eligibility checker. One of the first things your application will need to get through is your credit or CIBIL score. But what exactly qualifies as a good CIBIL score? Are people with low CIBIL scores ineligible for personal loans?

With some work, you could be able to get a personal loan even if it might be more challenging if your CIBIL score is low. Check your CIBIL Score for free with Bajaj Finserv for free.

Taking out an Instant Loan when your CIBIL score is low

Even though it may be difficult, you can still receive an instant loan with a bad credit rating if you follow the steps below:

- Provide proof of income to back up loan repayments

You may have a poor credit rating, but a raise in salary or the addition of another source of income may persuade the lender to consider your loan application. Furthermore, if you can demonstrate that you have a stable job with a consistent revenue stream, your chances of obtaining a loan improve. You should be aware that you may be charged a higher interest rate.

- Think about getting a small personal loan.

With a low CIBIL score and a sizable personal loan request, your lender might consider you to be a high-risk candidate. According to the lender, you have a higher likelihood of missing a loan payment. The lender might be more inclined to grant the request if the personal loan is for a smaller amount. In addition, paying back a smaller amount will be considerably simpler.

- Obtain a guarantor or apply for a joint loan.

Having a co-applicant or guarantor with a good credit score might speed up the process of getting a personal loan with low CIBIL score. Make sure the KYC procedures are carried out. Along with the necessary signatures on the necessary documents, with your co-or applicant’s guarantor’s approval.

It surely helps you get a better deal when a lender discovers a co-applicant or guarantor on your loan application with a respectable CIBIL score.

- Correct Credit Report Inaccuracies

With a poor CIBIL score, you may find it difficult to obtain a personal loan. However, there is a chance that your credit report contains mistakes or misreporting.

- Request that your lender consider your case if your credit report shows a NA or NH.

A credit period that was inactive in the previous 36 months or the lack of a credit period during that time is indicate by a NA or NH on your credit report. As a result, your CIBIL report won’t contain any information on your credit score.

Tell your potential lender why there has been a period of credit inactivity. It’s likely that the loan will have a higher interest rate applied to it.

Even though following these procedures can help you get an immediate loan despite having bad credit, you’ll still need enough cash to make the repayments on time. If you default on the loan, your CIBIL score will be further decrease.

Go to Home Page